Little Switzerland Credit Card – What Is It? Many of our readers seem to have the same question. If you are in need of a Little Switzerland Credit Card or you want to know more in detail about this credit card, then we have got your back. We have written this post with various information related to the Little Switzerland Credit Card.

So, without spending more time here, let’s get to it…

What is Little Switzerland Credit Card

It is obvious, isn’t it? Here we are talking about a credit card. And, you can see that the name of the card is actually related to the name of a popular luxury jeweler and watch chain shop named Little Switzerland.

So, you might already be able to guess that this credit card is a retail store credit card that could be used to shop in Little Switzerland. And, there are a lot of benefits of having the Little Switzerland Credit Card if you are frequently shopping at Little Switzerland.

Which Bank Issue the Little Switzerland Credit Card?

Now, before we start talking about the Little Switzerland Credit Card and its benefits, we should introduce the bank that issues the card. You might think that Little Switzerland does this on its own. But in reality, Comenity Bank is the one behind issuing the Little Switzerland credit cards.

Comenity Bank might not be a well-known name to you. But it is one of the primary and biggest credit card issuers in the world. Matter of fact, they have over 50 million cardholders and they have partnered with more than 150 retailers and stores all around the world. And, among them, Little Switzerland is one.

This bank doesn’t only offer retail credit cards, they also have high-yielding savings and deposit accounts. Interestingly, retail credit cards are easier to get. So, if your credit score is not in a good shape, you can actually try to qualify for one of these. And, later, you can use one of these as a credit-building option as well.

So, in short, we can tell that the Little Switzerland credit card is a typical retail credit card issued by a bank named Comenity Bank specifically for the Little Switzerland Luxury Jeweler stores.

So, if you want to shop in Little Switzerland Luxury Jeweler and get some of the best financing deals, then you should get a Little Switzerland credit card.

Little Switzerland Luxury Jeweler

Now, that you know what is a Little Switzerland credit card and about the bank that issues this card, we can proceed to know about the store you can use this at.

Chances are, you are already pretty familiar with the Little Switzerland Luxury Jeweler shops. This chain luxury jeweler and watch shop is authorized by many world-renowned luxury watch and jeweler brands.

Some of the watch brands ‘Little Switzerland Luxury Jeweler’ offers are Cartier, Rolex, Hublot, Patek Phillipe, Omega, Citizen, Tag Heuer, Breitling, and so on. And, when it comes to designer jeweler brands, they have partnered with Roberto Coin, David Yurman, Pandora, Tiffany & Company, John Hardy, and more. They have their stores in various popular locations throughout the Caribbean. For example, you will find them in Nassau, Dominican Republic, Barbados, Aruba, and many other places.

They offer tax-free and duty-free savings on most of their products. Also, they have a ‘Best Price’ guaranteed feature. So, you know that you are getting the best price while purchasing from them. So, if you are looking for some luxury jeweler or watches, Little Switzerland is there for you.

Why you should get a Little Switzerland Credit Card?

So, at the moment, we have shared some information about the Little Switzerland store and the bank that issues the Little Switzerland credit card. But why should you get this credit card? Are there any benefits of the Little Switzerland credit card?

If you are not skimming the post, then you should have already known that this Little Switzerland credit card has a lot of benefits if you are a frequent buyer at Little Switzerland shops. According to Little Switzerland, the main 2 benefits of the Little Switzerland credit card are:

- Increased purchasing power

- Special financing options

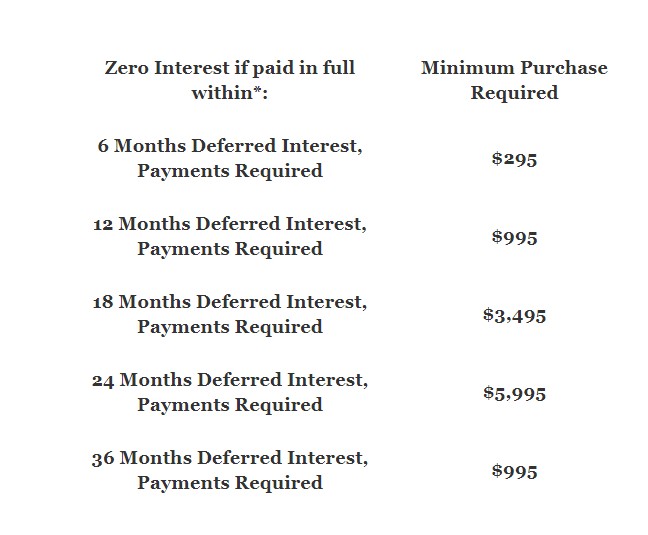

One of the most interesting offers of the credit card is that there will be no interest in your purchased amount if it is paid within a particular date range. Here is a close look at the conditions of the ‘Zero Interest’ policy of the Little Switzerland credit card.

Financing Options

- No interest if paid in full within 6 months: Minimum Purchase Required is $295 (Payments Required)

- Zero interest if paid in full within 12 months: Minimum Purchase Required is $995 (Payments Required)

- No interest if paid in full within 18 months: Minimum Purchase Required is $3495 (Payments Required)

- Zero interest if paid in full within 24 months: Minimum Purchase Required is $5995 (Payments Required)

- No interest if paid in full within 36 months: Minimum Purchase Required is $995 (Payments Required)

Remark: These credit card financing options can change anytime. So, the best option is to visit the nearest Little Switzerland store or contact your personal shopping consultant.

For your information, the financing places will depend on the purchase amount. Also, interest will be charged if you could pay in full within the promotional period. Of course, if you want to learn more about their different financing options, you can contact the support team of Little Switzerland.

To do that, you can send an email to [email protected]. Or you can call (888) 527-4473 to get customer service. You can also send emails to [email protected], if you have any other inquiries.

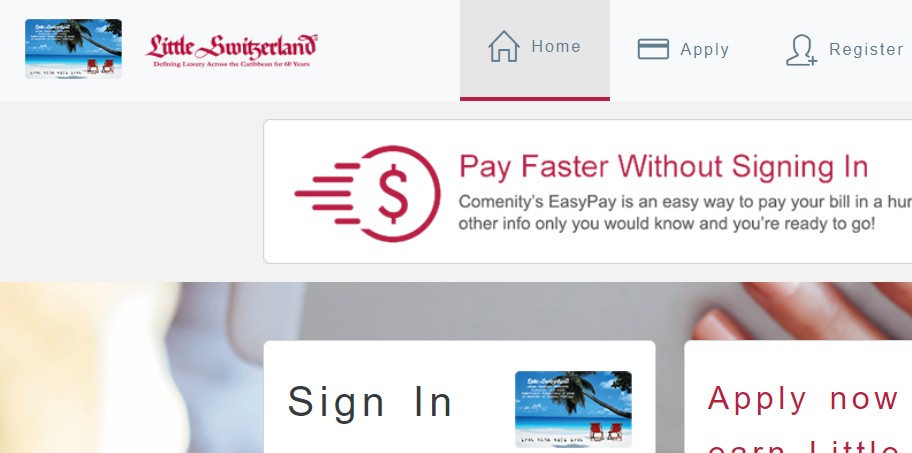

How to Apply for a Little Switzerland Credit Card?

So, at last, you have found the perfect jewelry or watch you were looking for a long time at Little Switzerland. Now, you wish to finance the purchase so that you will be able to pay for it on a schedule that fits your budget and time.

And that’s when you can get a Little Switzerland credit card. But how do you apply for one? What are the requirements to get a Little Switzerland card? In this section, we will learn more about this topic.

Requirements of Getting a Little Switzerland Credit Card

Like any other credit card, you must meet some requirements to be eligible for getting a Little Switzerland Credit Card. Now, to know more about the requirements, you can visit their Financial Privacy Policy page and the Online and California Privacy Policy page. Then follow the steps below to apply for a Little Switzerland credit card. Remember that, it is a credit card issued by the Comenity Bank. So, you must meet their particular requirement as well.

Steps to Follow

- Go to the Apply page of Little Switzerland Credit Card

- Then you will have to enter various information relevant to your credit card account in 3 steps

- So, fill in the forms by entering the required information. Make sure you are providing the correct information in the process

- It will take only up to 10 to 15 minutes to fill out the required information

- After applying, you will have to wait

As the card will be issued by the Comenity Bank, they will now verify the information you have provided during the application process. Next, if your application was approved, you will receive all the information regarding the new credit card and the account. And, from now on, you can enjoy all the benefits of the Little Switzerland credit card.

Concluding Thoughts

We have tried to make everything apparent about the Little Switzerland Credit Card for our readers with the help of this post. So, if you think you are going to shop at Little Switzerland stores, then you should get the Little Switzerland Credit Card without a doubt.

It will help you in many ways. In addition, Little Switzerland offers various luxury items without any tax. This is also another important factor to consider while buying from the Little Switzerland store. One last thing to remember is that all the specified credit card offers are subject to credit approval.

As always, if you have any other questions or queries, you can leave them in the comment section down below!