Though our whole lives revolve around money, cash is slowly becoming something from the past.

One of the main purposes of modern society is to live cashless, that everything becomes digital, fast, and instant without the involvement of bigger third parties, that is why online payment services have become so popular daily.

If you are looking for new ways for managing your money, this next post will be great for you, because we will talk about one of the most popular online banking platforms at the moment, Zelle.

Keep reading if you would like to know what Zelle is, how it works, how it makes money, and the advantages and perks it offers over other similar platforms.

What is Zelle?

Zelle is a payment network that allows users to manage their money from their bank accounts. Its main purpose is to transfer money from an account to another registered bank account.

Zelle can be used from any mobile device and has a very understandable interface that would make any bank transaction almost instantly. This type of service is known as a peer-to-peer (P2P) platform, meaning it only involves the sender and the receiver of the trade.

The service comes very handily because you don’t need to contact your bank to do your payments, and you only need a few data about the other person to send them money. Also, it can be used with a lot of banks, which are part owners of the service, such as BB&T, Wells Fargo, JPMorgan Chase, Bank of America, and more.

Though it was reported that Zelle facilitated more than $307 billion in transactions, the platform doesn’t receive any fee, so how does this multi-billionaire company make money?

How does Zelle make money?

https://play-lh.googleusercontent.com/5NmCkuU4Tb8R_M5ub5KPW9drFqDiqjBEpncoOzW83TKV0E5sid1Cyt4RkbfAKo9aiHo=w600-h300-pc0xffffff-pd

As we mentioned before, Zelle doesn’t charge the users commission, which is one of the best attractions of the platform.

Either if you are transferring money to accounts from different banks or if you are sending a big amount of money, Zelle won’t take payments. This is basically the company’s motto since they pretend to keep the app accessible and free for everyone, at least for now.

However, there is a way that Zelle can charge you a 1% fee, but only if you are a merchant and you are buying any goods and services.

Yet, this fee doesn’t go to Zelle, but to the bank that is involved in the transaction. Usually, these banks are part of the Early Warning Services, which owns Zelle, but the platform works with over 924 financial institutions.

In the early days of the platform, their policy was very different, and they charged a fee for each transaction. Still, this only made users avoid the service and it was one of the first things they changed on the platform when they took a radical turn on the company and started being the Zelle we know today back in 2016.

How does Zelle work?

Being a P2P service, Zelle works with joint bank accounts that are located in the same country to transfer money from one to the other.

It uses the money on your debit card to do the payments, which will also be sent to the bank account of the receiver, unlike other similar platforms that can hold money on the service as it is.

Your bank account is linked to your phone number or your email and you can send any person the amount of money you would like, as long as they have a Zelle account too.

Who can use Zelle?

https://dossierinteractivo.com/wp-content/uploads/2021/11/zelle-3.png

Every person that has a US bank account can use Zelle. As long as you are based in the US and you are old enough to register on the service, you can start using Zelle right now by downloading their app or going to their website and creating your profile.

Some banks have Zelle already available in their app, so you can have access to the service directly through it. After you enter Zelle, you will have to select an email address or a US phone number that will be linked to your profile and will make finding you easier for your friends and family whenever they have to send you money.

Then what is left is to link your bank account, or even multiple accounts, so you can use your money whenever you want.

How to send money with Zelle?

Here is a quick guide on how you can use Zelle, once you have created an account and you are ready to send money:

- Open Zelle on your device.

- Make sure you are logged into your account and go to the section called Send Money.

- Look for the user you would like to send money to.

- Write the amount of money you want to transfer.

- Once you are sure this is the person you want to send money to and the correct amount, tap on Next.

- There will be a box that says What’s this for, where you can write the purpose of the money.

- Finally, tap on Send to confirm the operation.

https://www.google.com/search?q=send+money+on+zelle&client=ms-android-motorola-rvo3&prmd=ivn&sxsrf=ALiCzsZcJ7M25j7Ak6r30ky5yg_ijH5OGQ:1653933033412&source=lnms&tbm=isch&sa=X&ved=2ahUKEwj34sDX5If4AhVtl5UCHWg0AmkQ_AUoAXoECAIQAQ&biw=412&bih=782&dpr=1.75#imgrc=rJYFOMVoYgUPwM

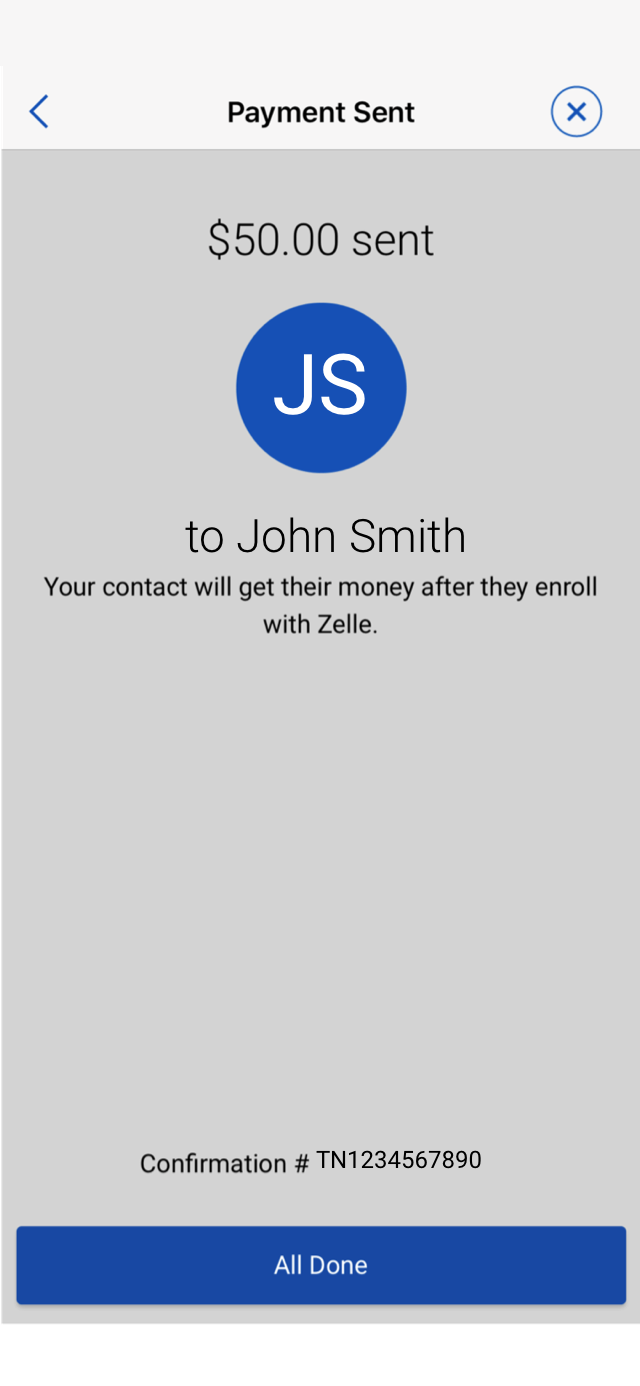

Tip: the transaction should be immediate, but depending on the condition of your funds, or if the receiver is a first-time receipt, it can take a couple of minutes or even hours. Also, it will be automatically deposited on their bank account, and they will be notified of the money, if they don’t have their bank account enrolled on Zelle, you won’t be able to send them money.

Usually, Zelle won’t have a daily limit on the amount of money you can send, still, if your bank doesn’t have Zelle, it can have a limit of around $500 per week, depending on the policy of the so-called bank.

It works differently when you receive the money since you can get a limitless amount from multiple accounts on the same day. Lastly, the transaction can be canceled only if the payment hasn’t been credited to the receiver’s account, that is why you have to be very sure you are transferring the money to the right person.

How to receive money from Zelle?

If you currently have a Zelle account, you don’t need to do anything to receive money, other than sharing your data with the person who is going to send you money.

In case you are a first-time user, you have to make sure your account has been verified and that your bank account is linked to your profile, otherwise, Zelle won’t have a confirmation about your identity nor a bank account where to receive the money.

Zelle vs Venmo vs Cash App

Zelle has been around since 2011, formerly with the name of clearXchange, and has proven to be a reliable platform that only pretends to keep on growing. Still, just like any other platform, there are other companies with a similar purpose that are Zelle’s direct competition. We have gathered a few characteristics about Zelle and its competition to help you decide which service suits you the best.

Pros

Zelle:

- Free: as you may have noticed by reading this article, one of the greatest things about Zelle is that it is absolutely free. They don’t make a profit in any transaction and you can make multiple operations without fees.

- Universal: By universal, we mean that Zelle works with many different banks and financial institutions, unlike other platforms that tend to have limitations on the banks that have a covenant with them. Of course, this is always talking about American banks.

Venmo:

- Feed: Venmo works similar to social media, you can watch your friend’s profiles and be aware of their transactions, even when they receive money. Of course, this could be a con depending on your intentions for the app. It is, by far, more social than the rest of the payment services.

- No banks: unlike most payment services, Venmo isn’t connected or works with any bank. This means you don’t need to have a bank account to use the platform and can be used by any person in the world.

Cash App:

- Business: unlike its competition, Cash App has a special setup for small business owners. They have the option to enroll your business in the service to receive and do your payments through their platform.

- Bitcoins: this is a recent feature on Cash App and is very rare among regular payment services. You can buy, sell and manage your Bitcoins using only Cash App.

Cons

Zelle:

- Local: sadly, Zelle can only be used in the US, it doesn’t allow international banks to send nor receive money, at least for the foreseeable future.

- Can’t connect credit cards: this is something Venmo stands for. If Zelle allowed credit cards, it would break one of the company’s purposes, which is a free-of-cost payment service, since credit cards imply a fee for both the user and the banks involved.

Venmo:

- Slow: this service is commonly known as a slower platform than the rest, even taking days to complete a transaction. This includes sending and receiving money and withdrawing it. Zelle, on the other hand, is known for being extremely fast and instant.

- Expensive fees: though you can use credit cards on Venmo and this can be a great perk over Zelle, this also implies the existence of commissions whenever you use it. They can get up to 3%

Cash App:

- Limitations: Cash App has low limits when it comes to sending and withdrawing money in a certain period. This also means that large transactions or constant unreported activity would be noticed as suspicious and can get you temporarily blocked on the platform.

- Federal Deposit Insurance Company: unfortunately, Cash App doesn’t have insurance coverage, unlike other platforms with FDIC that insure you up to $250 thousand. This means that if something happens to your money on the app, they won’t be held responsible for the loss.

Final words

That would be it regarding Zelle for now, hopefully, you now understand how this platform works and how they make money. Fortunately, if you are not a fan of Zelle other alternatives work similarly that may be better for you, as we explained earlier in the post. Feel free to share this with all of your friends so they can know everything about Zelle.