Are you thinking about getting the First Savings Credit Card? In that case, you must be familiar with all the terms and conditions of this credit card.

On top of that, you should also know if there are any better alternatives to this credit card.

You will not find a lot of information regarding the First Savings Credit Card on their official website. Also, they have an invitation-only application system.

So, it is a bit hard to know about this popular First Savings Credit Card(FSCC) for many of us.

To solve this issue, we have written this post. Here, we will be talking about the FSCC in a much detailed manner.

We will try to answer all of the questions regarding the FSCC in this post.

We will also share some information about a few good alternatives to the FSCC. By the time you have read this post, you will get very familiar with this particular card.

So, without spending more time, let’s dive right in…

What is the First Savings Credit Card?

As the name suggests, this is a ‘Credit Card’. First, Savings Bank issues this particular credit card. In simple words, the First Savings Credit Card is a credit card issued by First Savings Bank geared towards people with bad credit scores.

Added to that, it is an unsecured credit card. That means you will not have to deposit any specific amount before getting this card.

If you are a beginner in the game of credit or already have very poor credit scores, you can go with the First Savings Credit Card.

Another good thing about this credit card is that it is licensed under the MasterCard brand. So, you will be able to use it almost anywhere or where MasterCard is accepted (both online and offline). But there is a caveat here.

The FSCC has a variable APR and annual fee. All of these depend on your creditworthiness. So, depending on your credit score, you might have to pay a higher annual fee and a hefty APR (Annual Percentage Rate).

Offers of First Savings Credit Card

First Savings Credit Card doesn’t provide much information on their schemes or offers. However, we have found out that they have 5 different offers with various APR and annual fees.

As usual, your eligibility with these offers will vary depending on the creditworthiness and a few other factors like your income.

At the moment of writing this post, First Savings Credit Card has 5 offers, which you can see on the table below.

| OFFERS | APR FOR PURCHASES | APR FOR CASH ADVANCES | ANNUAL FEE |

| Offer No #1 | 14.90% (Will vary depending on the Prime Rate) | 23.90% (Will vary depending on the Prime Rate) | None |

| Offer No #2 | 29.9% | 29.9% | $75 |

| Offer No #3 | 29.9% | 29.9% | $49 |

| Offer No #4 | 29.9% | 29.9% | $75 |

| Offer No #5 | 29.9% | 29.9% | $75 |

If you want to know more, you can visit this link to find more detailed information about these offers.

Earlier, they were offering 6 offers. However, now there are only 5 offers.

So, which offer will you get? Interestingly, it is not specifically mentioned anywhere on their official website. But you can usually assume that you will have to pay the high APR and annual fee if you have lower credit scores.

Why Should You Get a First Savings Credit Card?

You might be wondering why you need a First Savings Credit Card. Simply put, there are a couple of good reasons to get this card.

First of all, if you have a bad credit score, the big banks or credit card issuers will not help you. Or if you are new in the world of credits, whereas you want to build good credit history quickly, then the FSCC would be a good choice.

People also go with this credit card as it is not a secured credit card. In that case, you can get this one without any security deposits.

The FSCC is a MasterCard. So, you will be able to use it anywhere MasterCard is accepted. Also, there are no hidden fees and no penalty APR.

You can also manage your account from anywhere in the world as they offer an online account and has an app.

Along with that, they offer fraud coverage for stolen or lost cards. All in all, it has a few great advantages so that you can go for the FSCC.

Who Should Get a First Savings Credit Card?

Now you know some of the reasons why you should get a First Savings Credit Card. But are you the right person to get it? Or are there better alternatives for you out there?

As we have already said that there are a few benefits of the FSCC above. If those ring true for you, you can get a FSCC. For instance, if you have a very poor credit score and want to improve it gradually, then the FSCC is a great option.

If you use this card to pay off a few smaller purchases or bills each month, then your credit score will increase day by day. Interestingly, the FSCC reports to the 3 major credit bureaus automatically every month.

So, if you pay off your payments responsibly each month, it will boost your credit score. For the record, reportedly, 35% of your overall credit score comprises your total payment history. You can see that it is a straightforward tool to get your credit score to a new high.

If you are one of them that likes an unsecured credit card, you should check it out because the FSCC is unsecured. You don’t have to pay any security deposits to be eligible for this credit card.

The FSCC has a variable annual fee and APR. It is based on your creditworthiness. If you have a very low credit score, then the fees will be a lot higher. In that case, you might not want to go for this unsecured credit card because there are other secured credit cards with lower fees.

If you want to pay with your credit card online or offline without any issue, you can go for the FSCC because it is a MasterCard, which is accepted mostly everywhere.

Pros and Cons of the First Savings Credit Card

Like most other credit cards, the First Savings Credit Card comes with its advantages and downsides. This section will talk about all these pros and cons of the FSCC. So, let’s go…

Pros

- Unsecured Card

You know this is an unsecured credit card. That means there is no need to pay a security deposit before getting this card.

- No Hidden Fees

There are no hidden fees or no penalty APR. Everything will be according to the offer you have got.

- Fraud Coverage

Suppose you lose your card; no need to worry about a penalty fee. They have full fraud coverage for lost or stolen cards.

- No Monthly or One-Time Fee

There is no monthly or one-time fee on this credit card. You will have to pay an annual fee, so there is no need to be worried about paying every month.

- If You Have Bad Credit Score

Most big banks or credit card issuers do not offer anything to individuals with poor credit scores. As a result, if you are one of them, you might not have any valid way to improve your credit scores.

In this instance, the FSCC could be your savior. Because to be eligible for this credit card, you will not have to have a good credit score. Also, if you pay off your payments or bills using your FSCC responsibly, your credit score will improve as well.

If you have a poor credit score and payment history and want to improve it, then the First Savings Credit Card could be one of the best options out there for you.

- MasterCard

You should already know that the FSCC is a MasterCard. That means it will be accepted anywhere the MasterCard cards are accepted. And, nowadays, MasterCard is accepted almost everywhere.

On top of that, you can use this for both offline and online purchases.

- Online Account Management

The FSCC offers an online account for each cardholder. You can manage everything from that account. And, their online gateway is up to date with all the latest security.

As you can manage everything your card-related from the online account, you will not have to visit the bank every time.

- Mobile App

You will be glad to know that they also have a mobile app for managing your FSCC account. It is available on both iOS and Android. With the app, you will be able to look over your account with ease and on the go.

- Low Fee for Additional Authorized Users

You are allowed to add new authorized users to your FSCC. And, for each user, you will have to pay only $20 per year.

- Reports to Credit Bureaus

First Savings Credit Card reports the cardholder’s activity to 3 of the major credit bureaus every month automatically. If you are using your card responsibly and pay off the bills or payments on time, your credit score will improve.

- Increase in Credit Limit

After the initial 6 months with the FSCC, your credit limit should increase if you use the credit card responsibly.

Cons

- Possibility of High Annual Fee

Normally, the First Savings Credit Card has variable annual fees based on the creditworthiness of the user.

As most users of this credit card would be with low credit scores, the annual fee would also be higher. But if you have a good credit score, then it will not be an issue for you.

- Invitation-only Sign Up System

There is no way to apply for the FSCC manually. You can only apply if you receive an invitation in the mail from them.

Also, there is no way to influence the selection for receiving the invitation mail as well. Also, even after the invitation, your application would have to be approved first to get your card.

- Very High APR

The First Savings Credit Card has a very high annual percentage rate (APR) on your purchases and cash advance. Moreover, if you have a bad credit score, you will have to pay a higher APR than usual.

- Low Credit Limit

At the time of writing this post, FSCC offers a starting credit limit of only $350 to the cardholders. In our opinion, it is a very low offer.

- No Reward System

Most popular credit cards come with extra perks. However, the FSCC does not offer any rewards program.

How do You Apply for the First Savings Credit Card?

Applying for the First Savings Credit Card is very easy. However, you need the reservation number and the access code first. How do you get those?

As we are saying through the post that First Savings Credit Card is an invitation-only credit card. So, you will receive these required codes in the acceptance form that they will send.

So, first, you will have to receive the invitation. Only then will you be able to apply for the First Savings Credit Card.

Assuming that you have received the invitation, we will share a step-by-step guide on applying for your new First Savings Credit Card in this section. Let’s go…

Steps to Follow

- First, go to the official website of the First Savings Credit Card from your favorite browser.

- Now click on the ‘Accept Online’ button, and you will be taken to the application page.

- On the next page, you will have to enter the ‘Reservation Number’ and the ‘Access Code’ that you have received on the acceptance form via mail.

- After you have entered the required codes, click on the ‘Continue’ button.

- In total, you will have to go through 4 steps to apply for a credit card.

- In the second step, you will have to enter some information about your mailing address to verify it.

- Next, on the 3rd step, you will have to provide more information to verify the acceptance form.

- On the 4th and last step, you will have to finalize the application by accepting the offer.

- Throughout the application process, you will have to provide any information like your personal identifying information, your income or employment status, and more.

As a result, try to enter all the valid and correct information if you want to get approved faster. And, after you have completed the application process, you will have to wait until your application is approved.

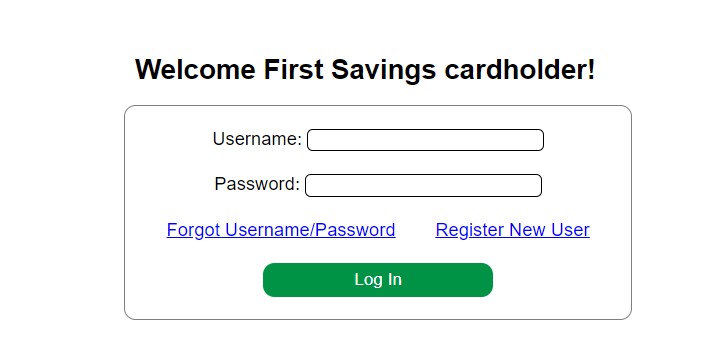

How to Login to the First Savings Credit Card Account?

Let’s say you have already received your First Savings Credit Card. Now, how do you log in to the online account associated with your new credit card?

It is effortless to do so. And lucky for you, we will be sharing a step-by-step method of logging in to your First Savings Credit Card account in this section. So, let’s go…

Steps to Follow

- As usual, go to the official website of the First Savings Credit Card from your favorite browser.

- Then, you have to click on the ‘Account Logging’ button from there.

- On the next page, you will have to enter the ‘username’ and ‘password’ of your First Savings Credit Card account.

- After entering the login credentials, click on the ‘Log In’ button.

- And you will be able to enter into your First Savings Credit Card account.

Similar to this, once you have logged in to your First Savings Credit Card account using the mobile app, you will be able to use it directly from the app as well.

How to Pay First Savings Credit Card Bill?

For the record, there are multiple ways you can pay the credit card bill of your First Savings Credit Card. Let’s talk about them in this section…

- Using the Online Account

First off, you can easily pay the bill directly from the cardholder’s online service portal. To do that, you will have to log in to your FSCC account. And, from there, you will be able to get the job done.

- MoneyGram or Western Union Money Transfer

If you are not good with online or the web, you can use money transfer systems like MoneyGram or Western Union to pay the First Savings Credit Card’s credit card bill.

For MoneyGram, you have to use the code 3890.

For the Western Union, you need to use this code: City/State: FSCC/SD.

- Through the Mail

Yes, you can pay the credit card bill of your First Savings Credit Card even via the mail. This is the mailing address for FSCC bill payment:

First Savings Credit Card

P.O. Box 2509

Omaha, NE 68103-2509

Remember to include your credit card account number with your payment via the mail.

- By Phone

Another way of paying the credit card bill of the First Savings Credit Card is via phone.

For this, you will have to dial 888-469-0291. Or else, you can also use your checking account on their official website.

- Via Debit Card

If you want to pay the bill using your debit card, it is also possible. However, there is a $3.95 processing fee with each payment via debit card.

- Via the Customer Service

You can also contact the First Savings Credit Card customer support team to pay the credit card bill.

Interestingly, they will walk you through the whole process. You can even pay via the debit card method with the help of the customer support staff.

What do the Users say?

As with any unsecured credit card, the First Savings Credit Card also has both bad and good customer feedback. However, we have noticed that it has received more positive reviews than bad ones.

Most of the cardholders complained about the higher annual fee and higher APR. They have also stated that the terms and conditions should be more detailed. Some of them didn’t know those until they have started to use the card.

On the good side, most users have praised this credit card.

They have stated that for individuals with low credit scores, it acts as a savior.

Also, they said it is effortless to work with. You need to make sure that you are paying off the balance before the 30-day mark, and you will be good to go.

They have also liked that it comes with an online account and an app.

FAQs about the First Savings Credit Card

This section will try to answer various frequently asked questions about the First Savings Credit Card.

How Long Does it Take to be approved to get a First Savings Credit Card?

Unfortunately, there is no specific answer to this. Many people reported that their application was approved within a couple of days. Simultaneously, some of them said that it took more than a few weeks to get their application approved.

Do I need an Invitation to Get a First Savings Credit Card?

Yes. The First Savings Credit Card is invitation-only.

That means they analyze the credit history of the to-be customers in the first place. And, then they send the invitations to eligible customers who might be interested.

But remember, just receiving the invitation via mail is not the confirmation that you will receive your credit card.

After you have received the invitation via mail, you will have to apply online. And, then they will analyze more information about you. Depending on that, they will approve your application.

How to Get an Invitation for the First Savings Credit Card?

Once again, there is no surefire way to know whether you are eligible for the First Savings Credit Card or not.

The company will send you the invitation in the mail if you are eligible. In this case, they will research your credit history and decide to send you the acceptance form. There is no way to influence this.

What type of Card is the First Savings Credit Card?

The First Savings Credit Card is a MasterCard. So, you will be able to use it wherever MasterCard is accepted. You can use it to make everyday purchases offline, or you can shop online using this as well.

Also, it is an unsecured credit card. Thus, you will not have to pay any security deposits to get this credit card.

How to Know If Your Application Was Approved for the First Savings Credit Card?

Once your application for the First Savings Credit Card is accepted, you will be notified by mail.

You will also receive your credit card with all the instructions on how to activate it. Also, you can check the status of your application on their official website.

What Credit Score Do You Need to be eligible for the First Savings Credit Card?

There is no accurate answer to this question. But we can tell you this; you will be able to get the First Savings Credit Card even with pretty low credit scores. But first, you will need to receive the acceptance form or invitation from the company to be able to apply for the credit card.

How to Cancel the First Savings Credit Card?

If you don’t want to continue using the First Savings Credit Card, you can cancel it anytime. To know the exact method of canceling your FSCC, you need to contact their customer support team.

Interestingly, they require you to let them know in writing that you wish to cancel your FSCC.

It is very easy to check the credit card limit of your FSCC. There are two ways to do that.

First, you can log in to your online FSCC account.

Secondly, you can also use their mobile app for this purpose.

When does First Savings Credit Card Update Credit Bureau Information?

For the cardholder’s convenience, the First Savings Credit Card reports to 3 major credit bureaus every month. As a result, your credit score will improve if you regularly use the card responsibly by paying off the bills or payments.

Are there any Mobile Apps for the First Savings Credit Card?

Yes. The First Savings Credit Card has both iOS and Andriod apps. You can install the iOS app from here. And, the android version of the FSCC app is here.

How to Increase the Credit Line with the First Savings Credit Card?

Unfortunately, there is no exact answer to this question.

Usually, it is known that the cardholder would receive a credit line increase after 6 months of using the card responsibly. That means you have been paying the bills within the due time, and then your credit line will improve.

However, a few customers stated that they had not received any credit limit increases after the initial 6 months even if they have paid the bills properly.

Some of the Alternatives

If the First Savings Credit Card is suitable for you, then you can go with this. However, if you think that this is not perfect for you, you have other options. For example…

As the name suggests, this is a secured credit card. You must deposit at least $200 to get this card. However, there is no monthly or annual fee. It has a 23.49% APR.

This is another secured MasterCard. It requires a variable security deposit amount based on your creditworthiness. The amount varies from $49, $99, or even $200. Like the previous one, it also doesn’t have an annual fee.

Another popular secured credit card is the Discover it Secured Credit Card. You don’t have to pay an annual fee for this. On the other hand, you have to deposit at least $200 as a security deposit. If you want, you can deposit up to $500 for a higher credit limit. However, this card has become popular because of its rewards program and cashback offers.

Sum Up

There you have it. We have tried to share our insight on the First Savings Credit Card (FSCC) with this post.

In the process, we have shared all the necessary information regarding this card. Moreover, we have also answered a lot of various questions related to the FSCC.

If you have read the post above, you should know the FSCC, whether you get it or not, how to get it, the pros and cons of the First Savings Credit Card, and more.

Thus, we believe now you will be able to make a final decision whether to go with it or not.

If you had any confusion regarding the First Savings Credit Card, all of those should be cleared by now.

As usual, don’t forget to share this post with others. And, if you have any further questions or suggestions, you can let us know in the comments below!

More posts for you: