Many card owners don’t know how to know if a credit card is active. In this post, we will be explaining all the ins and outs of credit card activity status.

If you want to use your credit card to make purchases or make any type of transaction, you will need an active credit card. However, there are many reasons following which your credit card may become inactive. And, if you haven’t been using the card for a long time, you might be confused about whether it is still active or not.

But fret not! Because we are here to help you. We have jotted down this post in response to this issue. And, we will be explaining multiple methods on how to know if a credit card is active or not in this very post.

So, without any further delay, let’s go…

Tutorial on How to Know If a Credit Card is Active

There are many ways you can try to know if your credit is active or not. In this section, we will share a few of them.

Method #1 Give it a Try

If you already have your credit card and want to check whether it is active or not, you can try to use it. Simply put, you can use it to buy something from a marketplace whether it is online or offline it doesn’t matter. Now, if your credit was declined, then it would typically mean that your card is not active.

However, there could be other issues related to this declination of the credit card. For instance, you might have tried to make the purchase with an expired credit card. In addition, it could also mean that you have already reached your credit limit. As a result, it is always better to know about your credit limit.

Now, what if you have lost or can’t find the credit card at the moment you are making a purchase. First thing first, if you think that your credit has been stolen, you must contact the card issuer or bank immediately and let them know about the situation. That way, they will be able to block the card. In the process, they will also start the process of supplying you with a new card.

Also, you can contact your card issuer if you want to know the credit card number or other information related to the card. However, in that case, you will have to provide them with a few pieces of information relevant to your accounts such as your social security number or ID card number.

Method #2 Call the Customer Care of your Card Issuer

The fastest way to know if your credit card is active or not is to call the customer care team of your card issuer. Generally, there will be a contact number at the back of your credit card. Also, you can find their customer support number from their official website.

So, give them a call and let them know that you are having issues with your credit card. And, they will check it for you whether it is active or not. However, in the process, you might have to provide some information to them for the verification process.

Method #3 Go To The Bank

It might sound obvious, but if you want to really know about your credit card all the other information regarding the credit card, then you can make a visit to the bank or the card issuer. This is one of the best ways to verify whether your card is still active or not. Because you are going to meet face-to-face with the staff of the bank.

Also, you will be able to ask any questions to them regarding your credit card as much as you want. We know that it is not possible to make a visit to the bank for many users. In that case, you can try the other methods mentioned here.

Method #4 From the Credit Report

In most cases, credit card issuers tend to report the status of the credit cards to the credit bureaus per month once. So, from that credit card report of yours, you will be able to find out whether your card is inactive or not. Remember, if the card is inactive, there will be no reason specified. So, you will have to contact the card issuer directly for that matter.

Method #5 How to Check If Your Credit Card is Valid?

In this method, we are not going to show you how to check if your credit card is active or not. Rather, we are going to show you how to check if your credit or debit card is valid. Using this process, you will be able to validate credit/debit cards from all around the world.

And, for that, you don’t have to go to any bank or anywhere for that matter. You will be able to verify your card from the comfort of your home. This method of verifying a credit/debit card will come in handy if you have just received your new card. So, let’s learn how to do it…

Steps to Follow

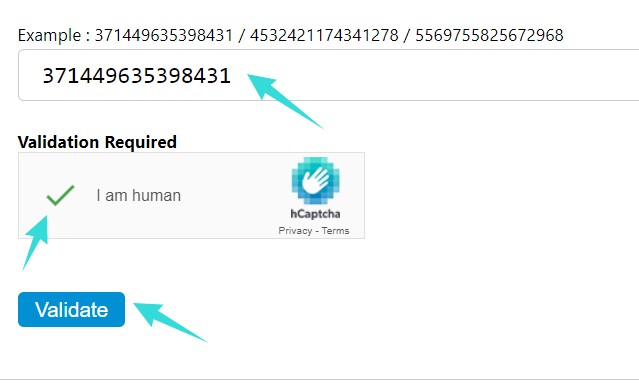

- Open your browser and visit bincodes

- Now, you will find a blank box on the page. Simply enter the credit or debit card number of your card

- Remember, you shouldn’t use space in-between the numbers. And, there should only be the numbers. For example, 371449635398431

- Next, click on the ‘I am human’ button below to verify

- In doing so, a new popup window will appear with a validation procedure. Simply, follow the procedure

- After you have successfully verified the captcha, there will be a checkmark in front of the ‘I am human’ box

- Now, you can click on the ‘Validate’ button

- Within a few seconds, your card number validation result will appear on the screen

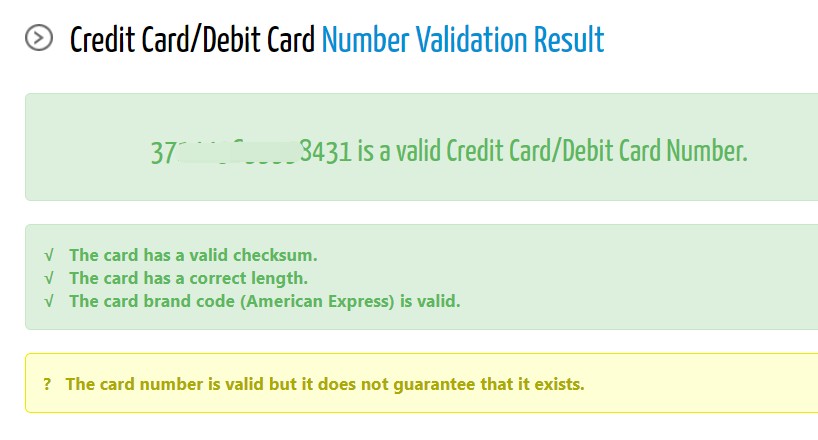

- If you want to know more information about the card, then you can scroll down to see the number breakdown and BIN details of your card

After you have found the result, you will see a message saying, ‘#your card number is a valid credit card/debit card number’. That means it is a valid card. On the other hand, if it shows as an invalid one, you must contact your card issuer or bank.

Things to Do When Your Credit Card is Inactive

Let’s say, you have found out that your credit is inactive. At that moment, you have a few things to do. First of all, if you want to know the reason behind the inactivity of your card, you can contact the customer support team of your card issuer. Next, if you need to reactivate the credit card, you will also have to contact them.

Now, depending on the reasons for the closing of your card, you might or might not be able to reactivate your credit card. In most cases, if the card was closed because of delinquency, then it might not be possible to reactivate it.

What to Do When Your Credit Card is Active

First of all, you can start using the card right away if it is active. However, we would suggest you know how much you will able to charge. The best option is to ask the card issuer about this directly. Following this tip, you are making sure you are not spending more than your credit limit.

Sum Up

If you were worried about the activity status of your credit card, we hope this post has solved the issue. Here, we have laid down multiple effective yet simple ways you can know if your credit card is active or not.

In addition, we have also shared a few tips on what to do if your credit card is either active or inactive. We hope this post will help you in managing your card better in the future.